THE 20/22 ACT SOCIETY

ABOUT US

The 20/22 Act Society is a membership-based organization composed of individuals from various places throughout the world, who have relocated to Puerto Rico due to the benefits provided under Puerto Rico Acts 20 and 22 of 2012. One of the first individuals to move to the Island was the founder of the 20/22 Act Society, Mr. Robb Rill.

The Society serves as a venue to clarify general concerns, gathering those interested in relocating with those that have already made Puerto Rico their home by sharing their experiences and making them part of a like-minded community. We provide free guidance to everyone that reaches out with an interest in relocating to Puerto Rico under the aforementioned Acts, to make sure that potential and current beneficiaries of tax exemption decrees granted under the Acts are fully cognizant of their compliance obligations.

Our ultimate purpose is to serve as the voice that encourages the significant impacts that the 20/22 community can have in Puerto Rico’s nonprofit sector. The 20/22 Act Foundation Inc. was established to support and work directly with local charities, by allocating monetary contributions that are obtained as part of the educational and social efforts made through the Society. We extend our help to diverse philanthropic areas, regarding but not limited to animal welfare, children, education, elderly care, and homeless areas. The Foundation is certified as a nonprofit organization under both; the Puerto Rico Internal Revenue Code Section 1101.01 and the Federal Internal Revenue Code Section 501(c)(3).

OUR MISSION

CHARITIES

The Society supports several local organizations. These charities grant scholarships for students to attend universities, which otherwise they could not have afforded the opportunity. They provide computers for children from low-income schools. They offer services to the homeless and the elderly on the Island. The Society also works to diminish the abandonment of animals through rescue, low-cost spaying, and neutering campaigns.

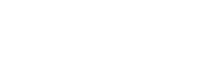

ABOUT PUERTO RICO

- Puerto Rico is an unincorporated territory of the United States located in the Caribbean with roughly 3 million residents.

2,897,951 as of as of 12/6/2019 – http://worldpopulationreview.com/countries/puerto-rico-population/

- Puerto Rico operates under the legal, financial, and banking systems of the United States.

- Residents of Puerto Rico are protected under U.S. law and do not require a passport for travel between the Mainland and Puerto Rico.

- English and Spanish are the official languages of Puerto Rico.

- Currency: U.S. dollar.

- The Gross Domestic Product per capita in Puerto Rico was last recorded at 27340.65 US dollars in 2018.

- Puerto Rico is part of U.S. free trade zones and customs system.

- Regulated banking system which is also insured by the Federal Deposit Insurance Company (FDIC).

- No federal income tax.

- Controlled Foreign Corporation (CFCs) tax treatment, in which federal income taxes are deferred until repatriation of profits.

- Cost Advantages vs. Continental U.S.

- Legal safeguards and presence of U.S. federal court.

- Puerto Rico is under the protection of the Homeland Security Act.

- Puerto Rico is under the U.S. legal framework and intellectual property protection.

- The Luis Muñoz Marín International Airport is the largest and busiest airport in the Caribbean.

- There are eight regional airports to reach every corner of the islands, most frequently used are on San Juan, Aguadilla, Ponce, Vieques, and Culebra.

- Many major airlines provide operations in Puerto Rico, including American Airlines, Continental, Delta, United, JetBlue, US Airways, Southwest and Virgin Atlantic.

- The literacy rate of the Puerto Rican population is 93.3%

- Highly acclaimed private schools for all levels of education.

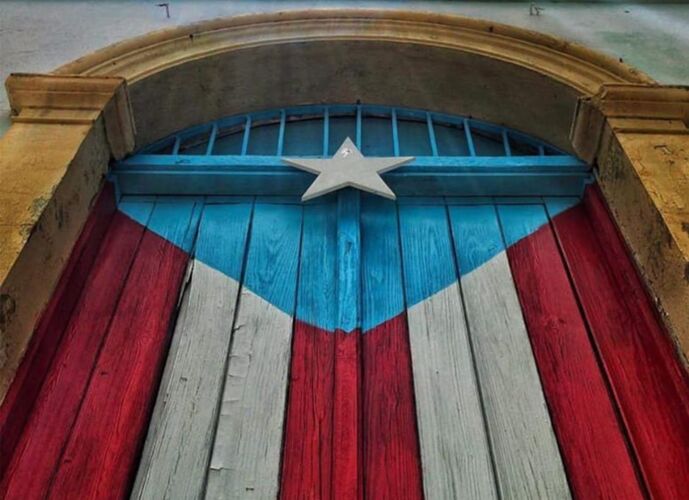

ISLAND LIFE

Following the Spanish-American War, Spain ceded Puerto Rico to the United States under the 1896 Treaty of Paris. At this time, the economy of Puerto Rico heavily relied on its sugar crop. In the middle of the century, free-market reforms spread across the island, transforming Puerto Rico into the manufacturing powerhouse and prominent tourist destination that we recognize today. The legislature of Puerto Rico sought to add to this legacy through Acts 20, 22, and 273, which have been recently codified and maintained under Act 60 of 2019, also known as the “Code of Incentives of Puerto Rico”.

Innovative and radical changes are taking place in Puerto Rico. In 2012, the legislature enacted a law to encourage investors and service providers of all industries to relocate their headquarters and service activities on the island. In return for the island’s gained economic growth, these organizations and individuals are allowed impressive and compelling benefits. These new benefits apply to individuals and organizations who relocate to Puerto Rico and include significant reductions of income taxes on long-term capital gains, dividends, interest, and revenues from services. These benefits are possible since the income generated from sources within Puerto Rico by a Puerto Rican individual or a Puerto Rico-based company is generally not subject to US federal taxes.

We, the 20/22 Act Society, are excited to share and educate how Puerto Rico’s legislative changes can benefit other service providers and organizations currently based in the U.S. This website serves as an informative guide, providing general information about legislation related to economic possibilities in Puerto Rico.